Cash value whole life insurance is a type of insurance that gives you the chance to receive a lump sum of money when you die. The money is based on the value of the policies at the time of your death. This type of insurance is different from term life insurance, which pays out a set amount of money each month. With cash value whole life insurance, the money you receive will be based on how much the policy is worth at the time of your death.

So why might you want to consider using CWL instead of traditional whole life insurance? There are a few reasons. First, because the cash value of a CWL policy is based on the market value of your investments, it can be a good way to protect your assets in case of an unexpected event. Second, because the premium for a CWL policy is based on what you would pay for an equivalent level of coverage if you were purchasing standalone coverage, it can be a

Cash value Whole Life Insurance policies provide an immediate cash payment upon the death of the policyholder. The policyholder's beneficiaries receive this immediate cash payment, which can be used to cover funeral and burial expenses, as well as other immediate needs. Benefits are also typically payable to the policyholder's estate.

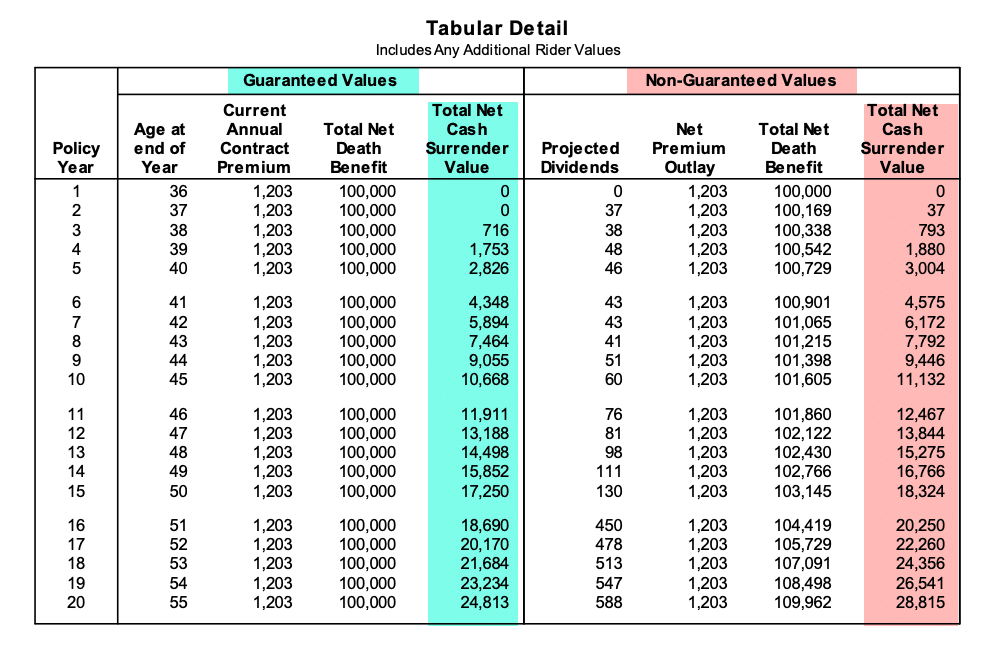

Image source: Google

However, there are several risks associated with cash value Whole Life Insurance policies. One risk is that the death benefit may not be enough to cover the beneficiary's financial needs. Another risk is that the policy may not pay out if the policyholder dies before the term expires. Therefore, it is important to carefully consider these risks before purchasing a cash value Whole Life Insurance policy.